Is retail media driving incremental sales or is it just cannibalising?

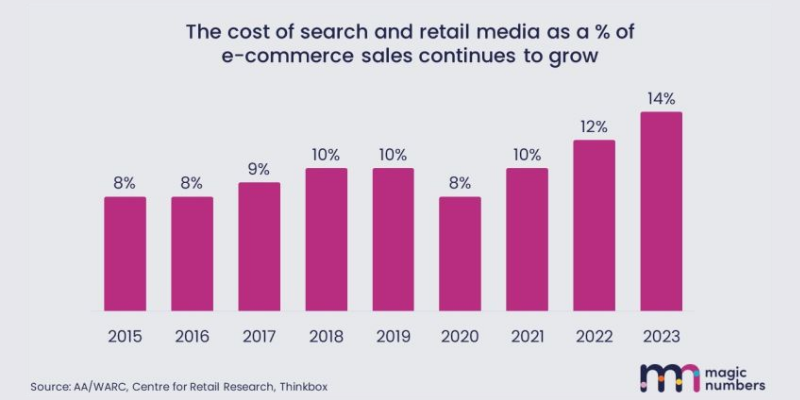

A great post by Dr Grace Kite recently identified that, broadly, retail media cost is growing as a percentage of brand’s sales, suggesting it cannibalises transactions already likely to happen. It’s an important point for us to recognise when approaching retail media. MMM reports suggest that greater value comes from brand building vs performance media. There have been several brands post-Covid that have been moving more budget to upper funnel tactics such as Airbnb, Nike and P&G covering a wide range of verticals.

From a Tambo perspective, we recognise that driving brand equity and helping consumers understand the core beliefs of the brand are key to long term success. Retail media’s role should be to convince those consumers that have not yet made their mind up on which brand they should choose. Of course ensuring that is the role it genuinely plays is the challenging part.

There are various retail media platforms where ads can appear within search results when a consumer already has that brand in mind for purchase - in this scenario you could effectively pay for a sale you would have got for free anyway. We can avoid these scenarios through some careful consideration that I will explore in the next few points:

What falls under ‘Retail Media’?

Retail media has a diverse offering so therefore should not be treated equally. Under the same retail media landscape, advertisers can buy placements on unique content within Prime Video, utilise Tesco Clubcard data to reach consumers based on specific buying habits or place a banner or product ad within a search result. The latter potentially being at the greatest risk of cannibalisation whilst Prime Video Ads and utilising vast retailer data to target could be much more effective ways of driving incrementality or brand building through video formats.

Find the incremental space

- Leading on from the previous point, placing a banner or product ad based on keyword targeting could be considered as a cannibalising tactic. In this scenario we need to strategise further and consider the audience that we want to target.

- Targeting brand keywords or even generic keywords in a category where our advertiser is the leader may not be driving incremental sales. Considering where our products appear in search results could be key for this tactic, we may want to avoid advertising where our products are ranking organically. We could also focus further on subtle competitor/complementary targeting to reach consumers who are browsing other products but not our own.

- Setting a KPI to avoid cannibalisation is key, monitoring overall sales through a Total Cost of Sale (TACOS) metric. Tracking this over time would give indication of whether paid sales are cannibalising organic sales.

Amazon particularly has evolved their targeting recently with the release of Audience targeting announced at their Unboxed event. This new feature enables advertisers to apply audiences to keyword focused campaigns to refine targeting through their broader advertising suite. This means that search marketing could be up weighted or down weighted based on a previous action a user has done before whether on Amazon or via another platform utilising AMC.

Investing in measurement

Measurement should be a fundamental part of any strategy - Within Amazon, utilising the basics such as NTB metrics to more advanced options such as AMC incremental reach reporting to understand the full user journey are essential. Regardless of the confinements of the Amazon walled Garden, it’s worth thinking broader. Brands should consider partnering with multi-channel incremental measurement solutions like Audience Project & MMM or econometrics companies like Magic Numbers to get true understanding of the channels that are working best for them.

If you need support on understanding how incremental your activity is amongst retail, DTC or marketplaces, please reach out.