Amazon's Ad Business Exceeds Coca Cola's Global Revenue

As many marketers are aware, retail media is an area of massive growth and has been a buzzword for some time. Amazon specifically is a big driver of this growth amongst many other retailers globally, we came across an article from theweek.com which landed this point through their headline “Amazon now makes more money from advertising than Coca-Cola's global revenue” - which is quite terrifying to consider. Amazon’s retail and logistics are seen as the companies core components to building it’s position of today but its ad business with revenue around $46.9B is clearly an important part however secondary, now has greater revenue than the most recognisable drinks brand on the planet.

This really shows that Amazon has now cracked the code, they have been the third largest media buying platform for some time now, behind Google and Meta but expecting more growth. Amazon has two key media platforms, Sponsored Ads which is typically recognised as the search arm and Amazon DSP which is the display buying arm. Sponsored Ads is typically the first point of call for many brands that are focused on performance as it’s relatively easy to measure incrementality and familiar with any brand that buys media via Google Ads. Amazon DSP has taken longer to gain traction but is recognised as the more interesting space particularly for more traditional media buyers.

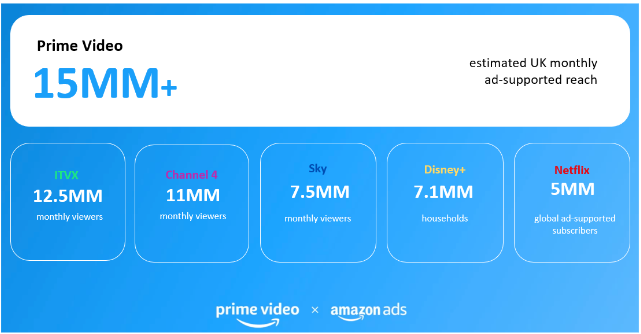

Amazon DSP enables advertisers to run well known tactics as other media platforms but has a huge advantage vs other media platforms as its inventory includes Prime Video as of this year. This was a huge move for Amazon and really gave them a better seat at the table for advertisers when comparing other media platforms. Prime Video has a substantial audience that can be leveraged by advertisers to surface ads on the big screen and apply sophisticated targeting to reach their intended audience. The chart below shows the estimated ad reach vs other platforms.

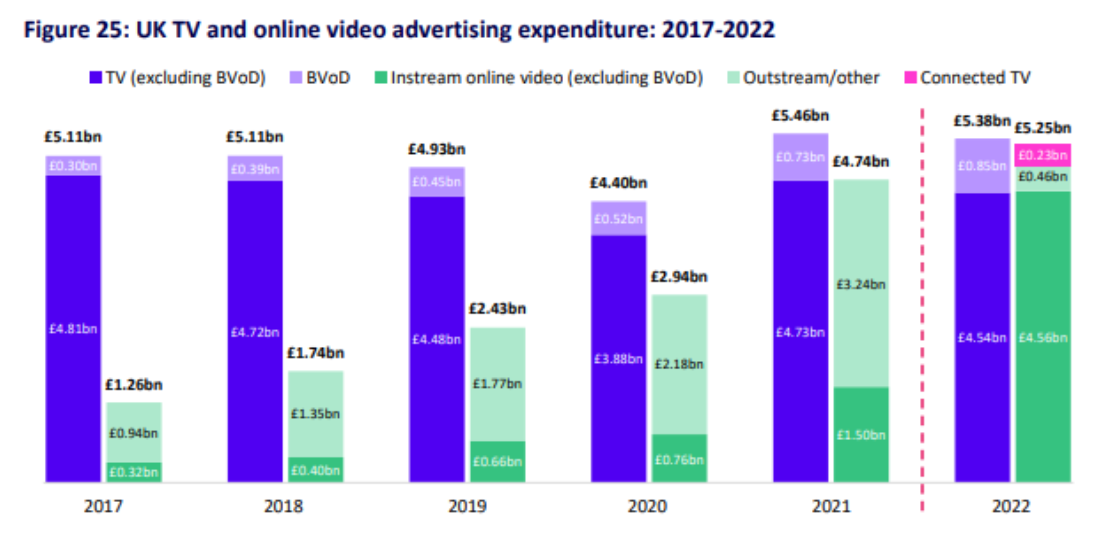

Amazon announcing that Prime Video would serve ads and correlates with the trend of where traditional media buyers are spending their upper funnel budget. It’s worth noting that TV is still important but VOD has become its equal over the past few years and can only be expected to grow based on consumer behavior. We can see from the chart below how that trend has happened over time and that gives some indication that VOD may exceed TV in 2024.

Amazon particularly has connected their eco system up effectively. Through Amazon marketing cloud, Amazon enables advertisers to connect all of their media on and off Amazon to understand incrementality and path to purchase. This reporting ability, plus the ability to layer complex targeting really makes Amazon a compelling choice for buying upper funnel media.

Considering it feels unusual that Amazon ads revenue exceeds that of Coca Cola, it’s really not surprising with the developments that are expected to continue. Amazon has cracked the full funnel approach from an advertising perspective and allows brands that do and don’t sell on Amazon to harness their capabilities. If you want any more information on Amazon’s advertising suite or have any other queries, please reach out!